Turnkey insurance infrastructure

Our API-driven systems and industry-leading reinsurance infrastructure delivers everything you need to launch and scale a profitable embedded insurance program.

How it Works

Boost’s platform integrates seamlessly into your own digital environment. Offer any insurance product on a fully white-labeled basis with your brand and experience, so that customers can buy without ever leaving your site. You’ll own the customer and the data, helping you build engagement and power future business decisions.

Your

Product

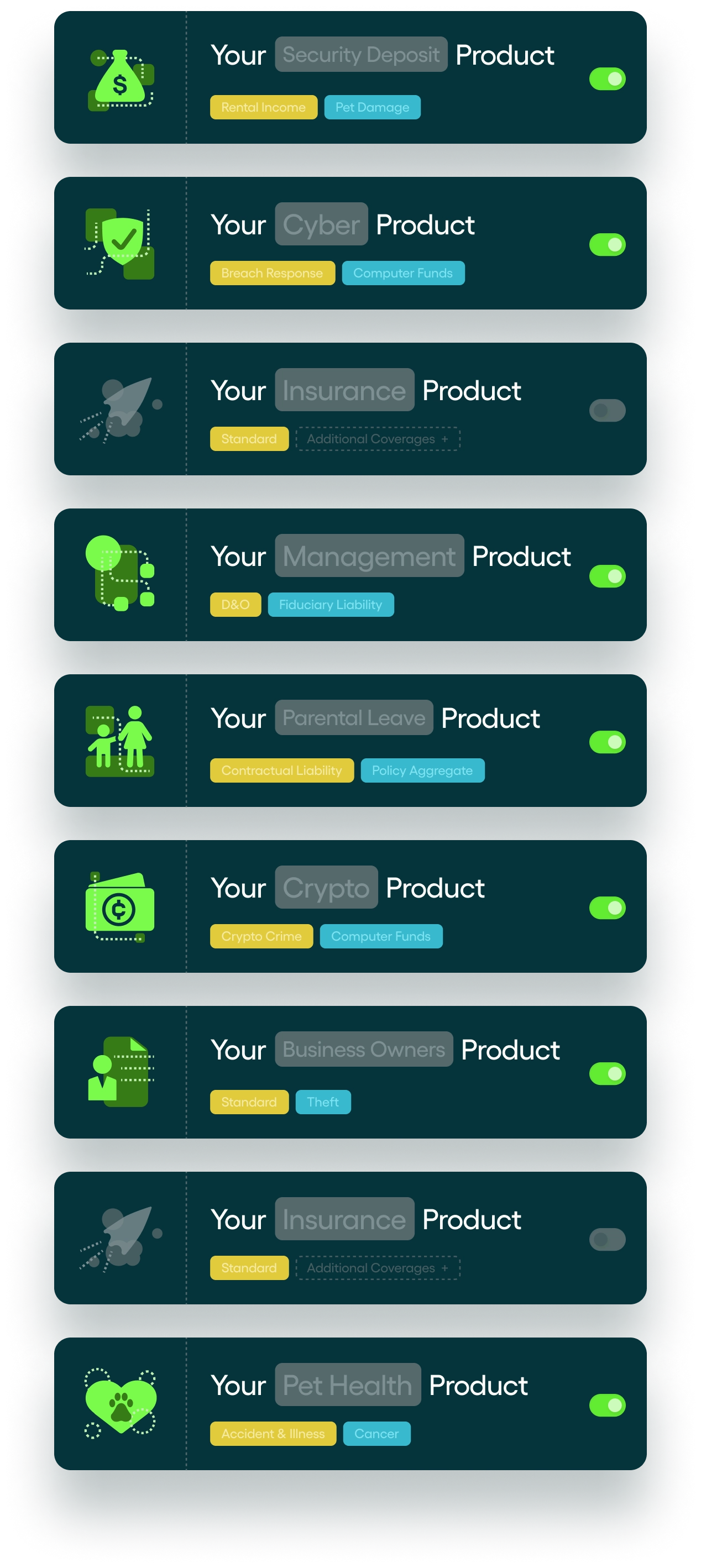

Select the coverages you want to offer your customers from Boost’s highly-customizable products

Seamlessly connect your digital experience to the Boost platform through our embedded insurance API

Launch your insurance program and allow your customers to buy and manage policies, without ever leaving your experience

1curl --request POST \

2--url https://api.insurtech.dev/auth/oauth2/token

3--data apiLogin=AbC123-8888

4

5curl --request POST \

6--url https://api.insurtech.dev/quotes

7

8curl --request GET \

9--url https://api.insurtech.dev/quotes

10--id quote_number=8888-9999-Tgx6

11

12curl --request GET \

13--url https://api.insurtech.dev/policies

14--id policy_id=AbCd-9999-0000

15

16curl --request PATCH \

17--url https://api.insurtech.dev/customers

18--id customer_id=0000-3333-4hgb

1{

2"token_type": "bearer",

3"access_token": "JDKSjkdnasknxkasjd",

4"expires_in": 7200,

5}

6

7{

8"data": {,

9"type": "quote",

10"id": "BLU-XX-T63XWYHFE",

11"attributes": {...},

12"relationships": {...}

13},

14 "included": [,

15{...},

16{...},

17{...},

18{...}

19 ],

20}

21

22{

23"data": {,

24"type": "customer",

25"id": "d0624f89-0437-4a82-a210-94fd8eea04ce",

26"attributes": {...},

27"relationships": {...}

28}

29}

30

31{

32"data": {,

33"type": "policy",

34"id": "4f118baf-e00e-4b18-92a5-775e00c8efaf",

35"attributes": {

36"reason": "insured-requested",

37"date": "2019-01-01",

38"description": "The insured has requested this

39cancellation.",

40}

41}Explore Our Products.

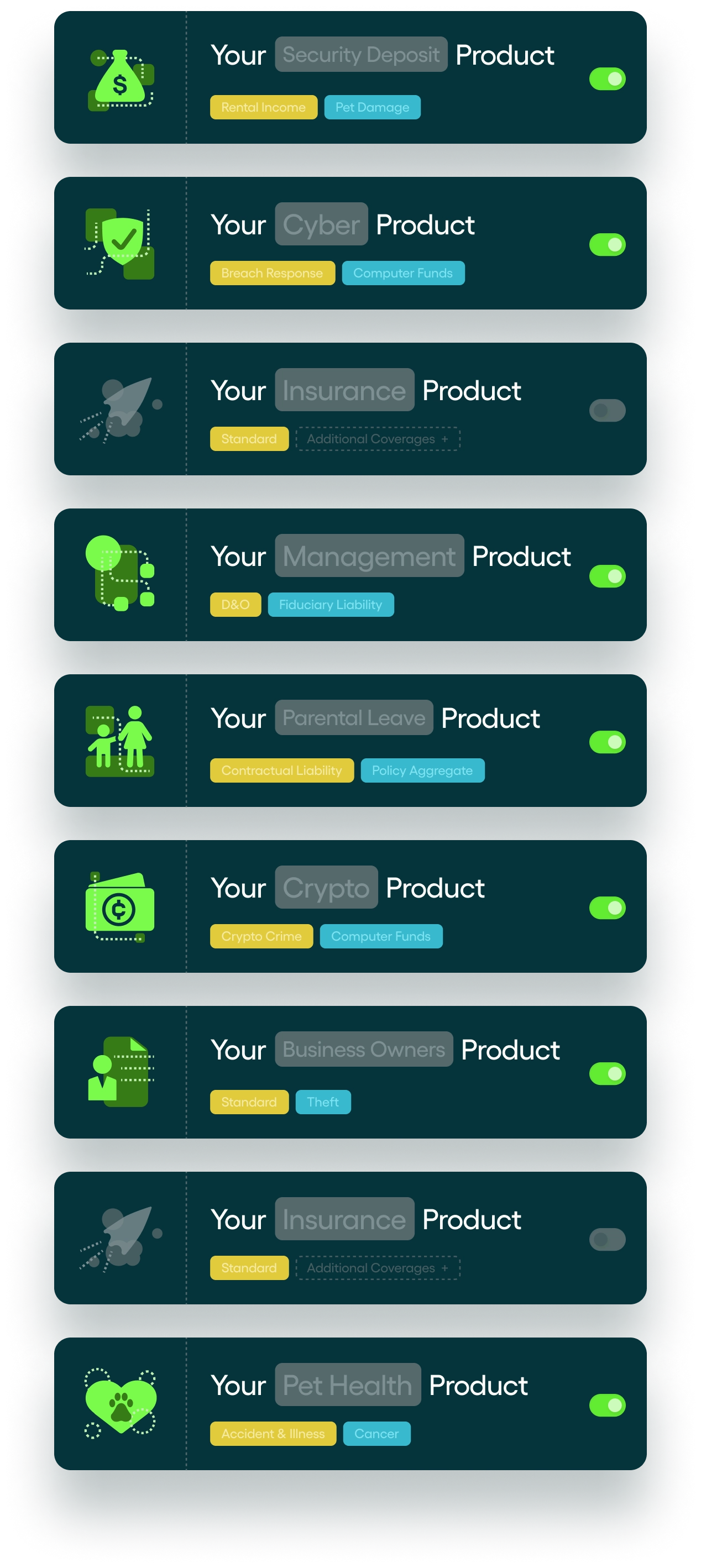

Build the perfect insurance package for your customers with our modular products, or work with us to create something new.

Give your customers increasingly critical protection against cyber threats

Learn MoreIncrease access to comprehensive, affordable business coverage

Learn More